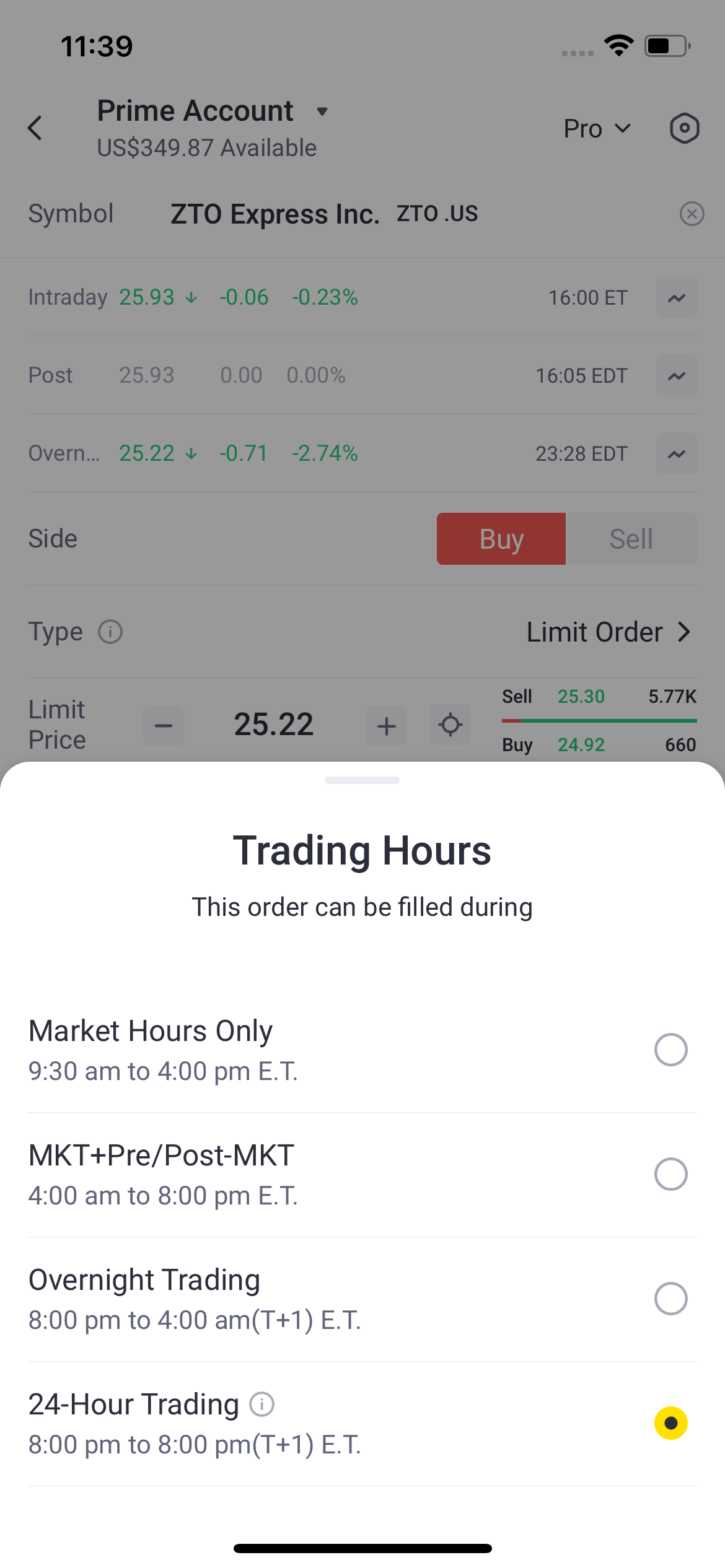

Overnight trading is a US stock market session outside of the regular trading hours. Tiger is offering two new trading hours options, namely the Overnight Trading and the 24H Trading, in addition to the existing Market Hours Only and the MKT+Pre/Post-MKT trading hours options.

What are the US stock Overnight Trading session, and 24H Trading?

Overnight Trading session: This trading session operates on Sunday to Thursday US Eastern time when there is an upcoming regular trading session the next day, starting from 8:00 p.m. to 4:00 a.m. the following day US Eastern Time.

24H Trading: Orders placed with this trading hours option are submitted to all trading sessions available upon their submission Sunday to Friday US Eastern Time, potentially spanning from 8:00 p.m. to 8:00 p.m. the next day US Eastern time, which could include the Overnight, pre-market, regular, and post-market sessions.

Which trading day does the Overnight Trading session belong to?

The Overnight Trading session belongs to the following day counting from the time a certain Overnight Trading session starts. For example, trades executed on a certain Overnight Trading session that starts Sunday 8:00 p.m. US Eastern Time will be accounted for as Monday US Eastern Time trades.

What are the transaction fees?

The same are charged for execution for all trading hours options.

How to place an order for Overnight or 24H Trading?

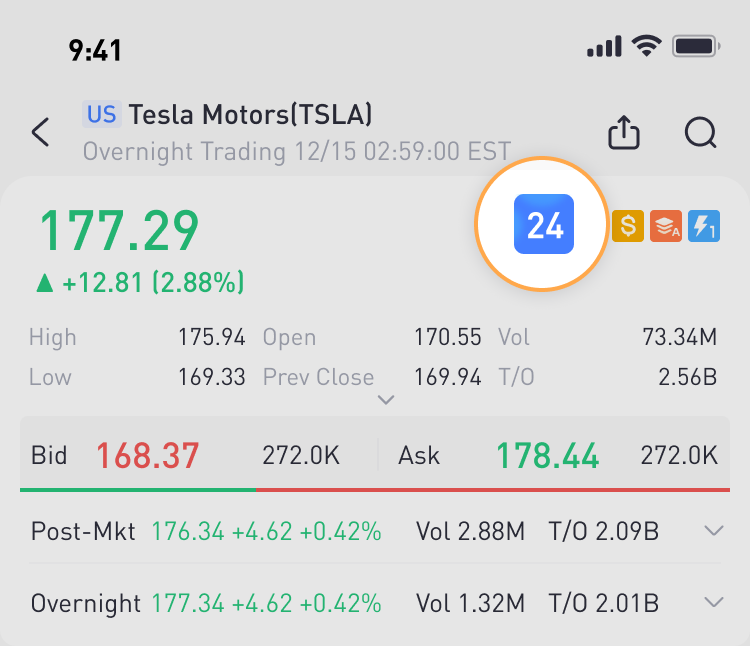

Look for the '24' logo displayed on the detail-quotation page to indicate if the Overnight Trading and 24H Trading options are available, as follows.

Orders placed with the Overnight Trading option can only be submitted during an Overnight Trading trading sessions.

Similarly, a Day order (Time in Force) placed with the 24H Trading trading hours option, say, during the pre-market trading session hours will NOT be submitted to any Overnight Trading session. Please refer to GTC orders if you wish any unfilled part of your order to be automatically resubmitted AS A NEW ORDER for the next trading day.

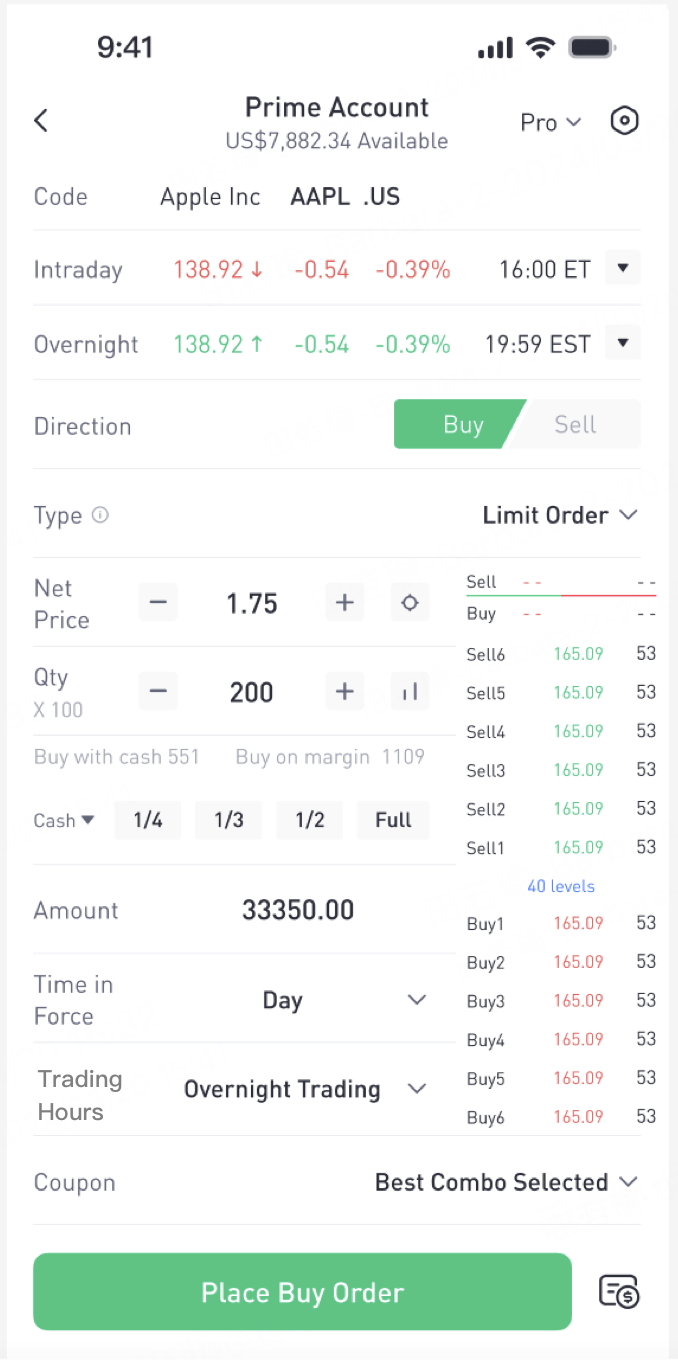

To place an order, go to a stock/ETF's order page, choose "Limit Order" for the "Type" field, and then choose your preferred "Time in Force" and "Trading Hours".

Trading Hours | Time in Force | |

Overnight Trading | Day | Expire automatically at the end of the overnight trading session. |

24H Trading | Day | Expires automatically at the end of the post-market trading session OF THAT TRADING DAY, i.e. will ONLY be submitted to all REMAINING MARKET SESSIONS FOR THAT TRADING DAY AFTER AN ORDER is placed. |

GTC | Expires automatically at the end of the post-market trading session on the first trading day after a GTC order has been in place for 90 calendar days. | |

Can I short-sell?

No. It is not supported.

Can I place attached orders?

Attached orders will NOT be triggered or traded during the Overnight Trading session, hence is not available to its corresponding trading hours option.

The 24H Trading trading hours option supports attached orders to the following extent:

Take-profit attached orders will be triggered and submitted for trading for all applicable market sessions apart from Overnight Trading market sessions;

Stop-loss limit attached orders will be triggered during a regular market session only, and then submitted for trading for all applicable market sessions apart from Overnight Trading market sessions;

Stop-loss attached orders will only be triggered during a regular market session, and will also only be then submitted for regular market hours' trading.

Further reading on attached orders is available here.

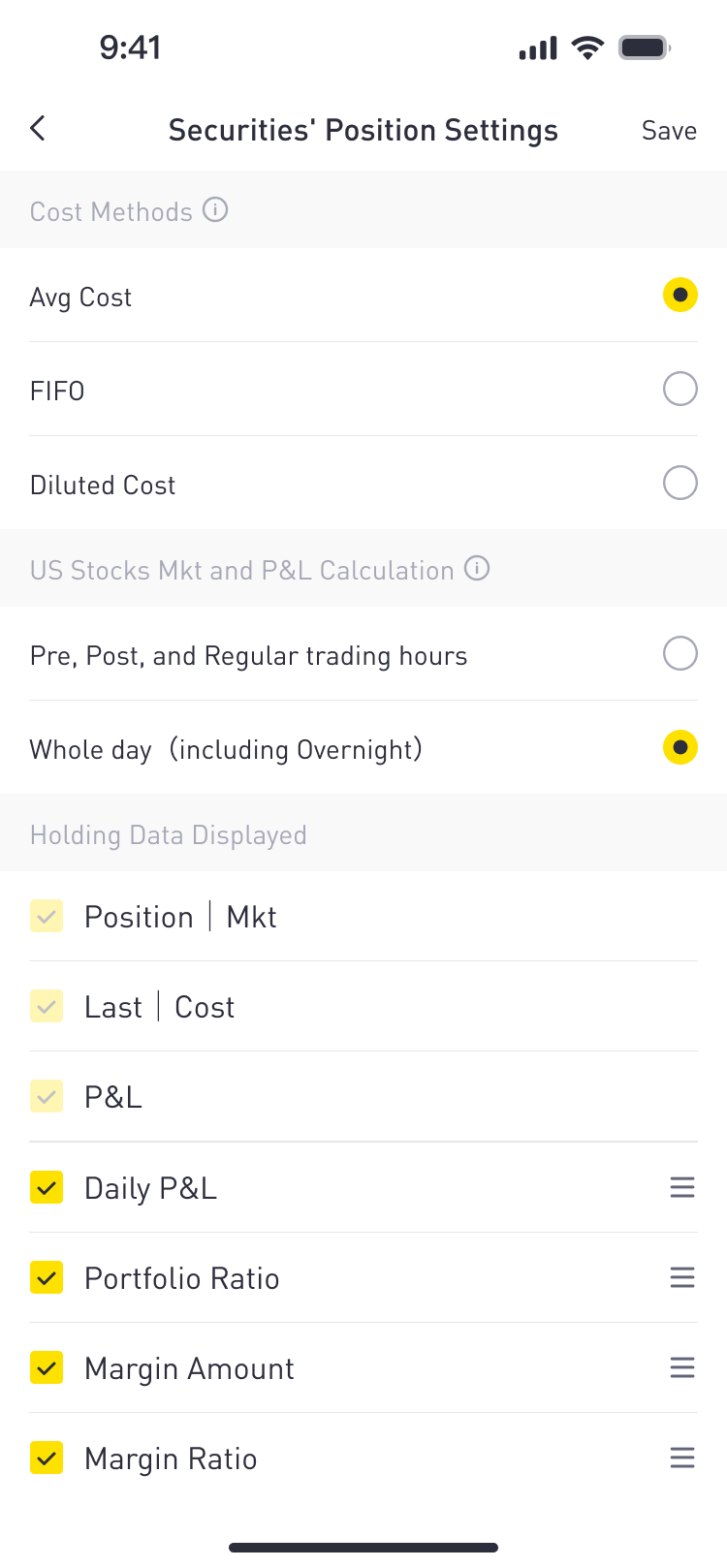

How are my position value and P/L calculated?

Your P/L can be calculated using the overnight price. Learn more.

Overnight Tradable List

This list is for reference only. Please refer to your Tiger APP for a certain stock/ETF to be traded in an Overnight Trading session.

Important NOTICE for 24H Trading Orders:

A brief loss of trading time will occur when the unfilled part of your 24H Trading order is being transferred/resubmitted to a different market session, namely (i) transfers to a pre-market session as a certain Overnight Trading market session comes to an end, and (ii) when applicable GTC orders are resubmitted to the Overnight Trading market session belonging to the following day. For example, a brief 10 seconds loss of trading time before an Overnight Trading market session ends, and a brief 10 seconds loss of trading time at the start of an Overnight Trading market session that belongs to the following day.