The first quarter earnings season kicks off this week, with major U.S. banks set to report starting April 11. For investors, the focus extends well beyond whether Q1 results beat expectations — the real spotlight is on forward guidance. Management commentary on the outlook for the rest of 2025 will be key amid growing uncertainty around U.S. trade policy.

As of April 9, the S&P 500 has fallen roughly 19% from its February 19 high. The benchmark index now trades at a forward price-to-earnings ratio of 18, slightly below the 10-year average of 18.6, suggesting some valuation reset.

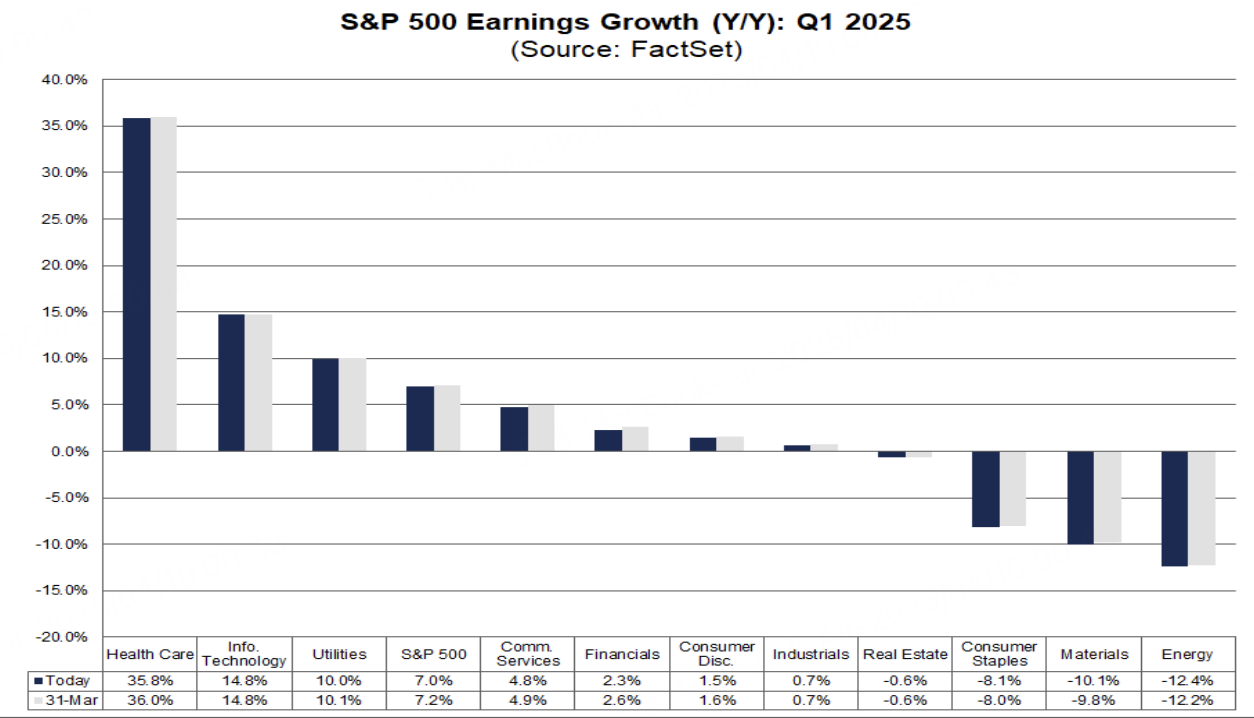

Among the 11 S&P 500 sectors, 7 are expected to post year-over-year earnings growth, led by healthcare, information technology, and utilities. On the downside, energy, materials, and consumer staples are projected to see the sharpest declines.

(Source: FactSet)

On the revenue front, Q1 sales forecasts have also been lowered, with analysts now expecting a 4.2% year-over-year increase, down from 5.1% earlier this year. If achieved, it would mark the 18th straight quarter of revenue growth. Ten sectors are expected to post sales growth, with tech and healthcare leading the way. Industrials is the only sector where sales are forecast to decline.

(Source: FactSet)

Looking ahead, full-year 2025 S&P 500 earnings are projected to rise 11.3%, but analysts caution that escalating tariff risks could derail that forecast.

Since peaking in February, major bank stocks have tumbled roughly 25%. Given their sensitivity to the economy, financials have come under pressure from growing fears of a tariff-driven slowdown. These fears raise the risk of sluggish loan growth, a flatter yield curve, weaker capital markets, and deteriorating credit quality.

Wells Fargo’s Mike Mayo warned that the biggest impact of tariffs may be rising loan-loss reserves, as banks brace for a potential downturn. “The risk of recession has grown,” he said, “and banks may need to set aside billions of dollars to cover possible defaults over the coming quarters.”